Gold

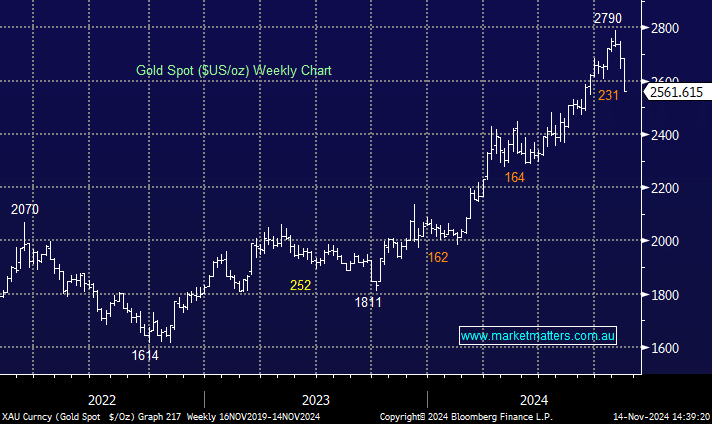

With the recent US$ strength, would you still have conviction to hold gold related equites (NST, EVN, WGX) & would you still consider the dips that occur opportunities to buy? Historically gold is still high with producers hopefully having good margins subject to cost execution with some possible higher dividends over the next reporting period? Saying this, should it be the case of not to hold a gold resource stock for the dividend? Has you view on the US$ changed since the US election result? Thanks as ever, Bernie Hi Guys Just wondering what your thoughts are on the decline of gold and related shares. Do you expect this to go much further? I have some gains on EVN, NST, BC8 and a few other gold plays, although gains are half of what they were a few weeks back. Not sure whether to sell before they drop further or hold. So the question is, do you expect this to be very short term and then for a recovery? If so, what’s your rough expected timing? Whilst things are looking bright with Trump in, ultimately the landscape is the same and I think a recession next year in USA is inevitable. Many thanks Kim Good Morning, precious metals have taken a hit with China and the strengthening $USD. Some of them - such as silver, platinum and copper - were initially pegged as beginning a multi-year bull run. Despite the current pullback, do you think this prognosis is still intact? Thank you again for your guidance. David