Hi Peter,

GMD is up 23% year-to-date pretty much in-line with many other gold names, e.g. Newmont (NEM) +21%, Emerald Resources (EMR) +20%, and Ramelius Resources (RMS) +20%, but there have also been a couple of standout underperformers including Bellevue Gold (BGL) -18% and Regis Resources (RRL) -25%.

We remain bullish towards gold with global interest rates set to fall over the next 12-months but we are conscious that our initial target of $US2525-2550 is very close at hand. This months presentation by GMD at the “Diggers & Dealers” conference was warmly accepted which has helped support the stock.

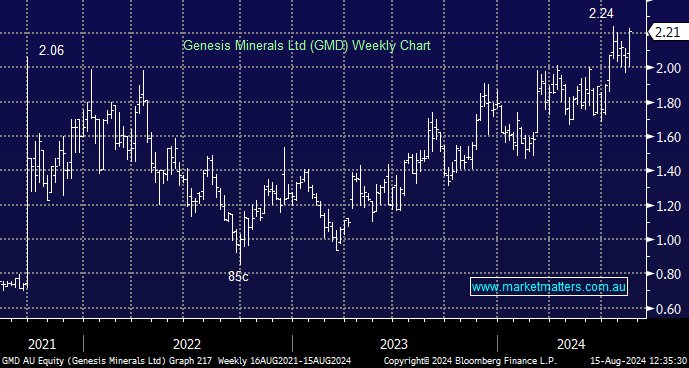

- We are bullish towards gold stocks and GMD as it tested multi-year highs towards the end of the week.

The stock remains popular with the broking fraternity with 2 Holds, 3 Buys and 1 Strong Buy. For us it will continue to follow the gold price and sector, in both directions. The large transaction on Thursday is not meaningful to MM until we see an interesting party arrive on the share registry.