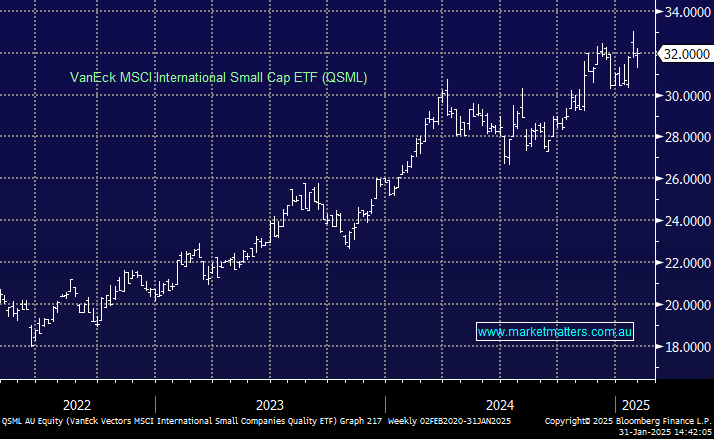

Follow-up on Quality Small Company & AI-Thematic ETFs – QSML & RBTZ

Dear MM Team, **I hope this question makes it onto the shortlist for this week's Q&A.** During last week’s Q&A, you mentioned the RBTZ ETF as a way to gain exposure to the AI theme. As a follow-up, I have a question regarding two ETFs - QSML and RBTZ. Given my mid-term investment horizon and preference for seeking consistent and reliable "growth" (through defensive, less volatile ETFs without picking each small or AI focused company), would these still be considered good buys at their current prices? If these ETFs are currently overvalued, could the team suggest an optimal entry price for buying into them? Looking forward to your insights. Regards SK