Hi Craig,

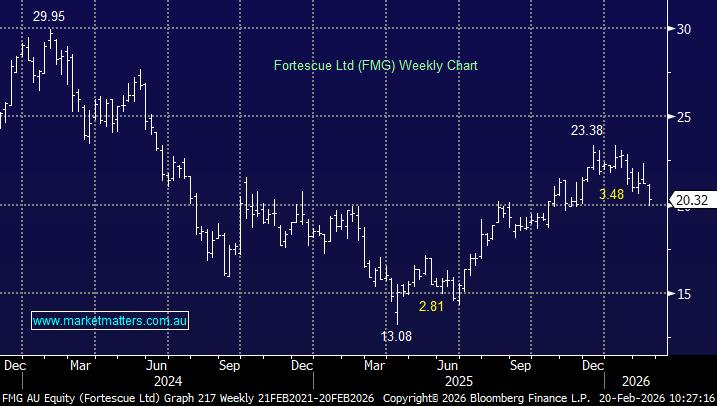

The chart tales the story here with BHP and RIO both punching to new all-time highs this week while FMG has corrected 15% in the last few months. From a commodity perspective FMGs lack of copper and its more than 90% dependency on iron ore is not ideal in terms of growth in the current cycle.

With Rio Tinto’s Simandou iron ore project, one of the largest and most significant new iron ore developments globally, set to add around 4% to total global iron ore production at full capacity (between 2028-2030) the iron ore price is likely to remain capped until the demand side picks up which will need an improvement in the soft Chinese economy.

However, this is not fresh news and the main reason FMG is languishing compared to its more diversified peers. In terms of dividend, it is expected to slip in the coming years with Bloomberg analyst consensus below:

- 2026 – $1.038

- 2027 – 83.3c

- 2028 – 78.9c

Lower dividends are function of the markets collective view around Iron Ore prices. While consensus has moved up from the mid 80’s for 2026/27, it’s still below current prices ($91 consensus on 2027).

NB We believe the analysts are being a touch conservative with option pricing suggesting higher dividends.

However, clearly its appeal as a yield play is expected to diminish over time, and this is certainly a consideration for us currently holding the stock in the Income Portfolio, particularly when BHP has just upped it’s payout guidance.