Hi John,

Two very different companies even if they are miners with large Chinese presence on the share register:

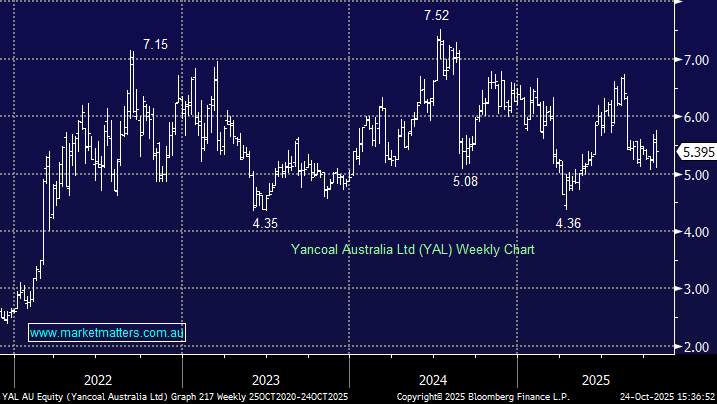

Yancoal Australia Ltd (YAL) – a $7bn coal miner which is ~75% by Chinese state-owned entities. The company is dual-listed company on the ASX and the Hong Kong Stock Exchange. It operates major coal mines in NSW, QLD, and WA, producing both thermal and metallurgical coal for export.

- YAL is forecast to yield 6.7% in 2026 although it did suspend its dividend for 6-months in 2024.

Assuming YAL doesn’t make a strategic acquisition, the dividends should keep flowing with YAL sitting on $1.8Bn in cash BUT they’ve pivoted before which saw the stock crash ~30% – this is not a yield play for the faint-hearted.

Fenix Resources Ltd (FEX) – we’ve written about FEX a few times in recent months and after trading ~50c for the last 5-weeks our view hasn’t changed. Even after its recent rally Fenix (FEX) is a still $370mn small cap, but operationally, it is peforming, and as you say, the chart structure is bullish.

- We continue to like FEX in the 46-48c region.

We like FEX as a more speculative iron ore play, though it is higher risk. YAL is an aggressive “yield play” but we wouldn’t compare the two! They are so different, offering two very different exposures. Really depends on what’s important to you, dividends or growth.