Hi Paul,

For subscribers not familiar with Felix Gold (FXG) it’s a small $134mn mineral exploration company focused on developing gold and antimony projects in Alaska’s Fairbanks Gold District. Its flagship Treasure Creek project targets near-term antimony production and significant gold resource growth.

Felix Gold’s (FXG) Alaska project is strategically important for diversifying global supply chains, especially as China continues to use its rare earth dominance for geopolitical and economic leverage. Antimony (Sb) is a critical mineral used in flame retardants, batteries, military applications, and electronics. With China controlling most of the global antimony supply, projects like Treasure Creek are essential for securing alternative sources.

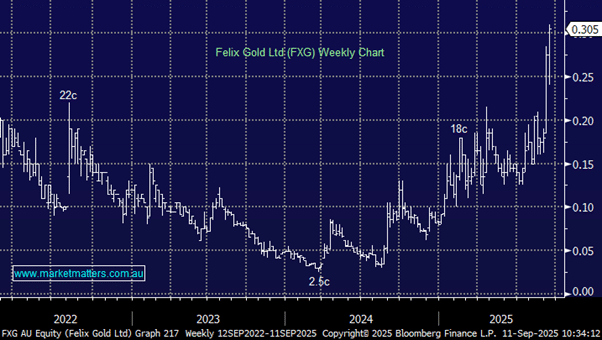

Valuing this explorer is hard, especially after its more than 10x fold rally from its 2024 low. However, they are on track to start production of antimony concentrate, in late 2025 or early 2026. FXG is targeting production of 5,000 metric tonnes per year of antimony concentrate from the Treasure Creek project with antimony prices hovering around $US25,000 per tonne = ~$190mn pa, not bad for a company of this size before we consider its gold potential.

- FXG is speculative stock, but it does look to have plenty of upside if the business can execute close to its hopes/targets.