Hi Gareth,

Two very different and interesting companies here:

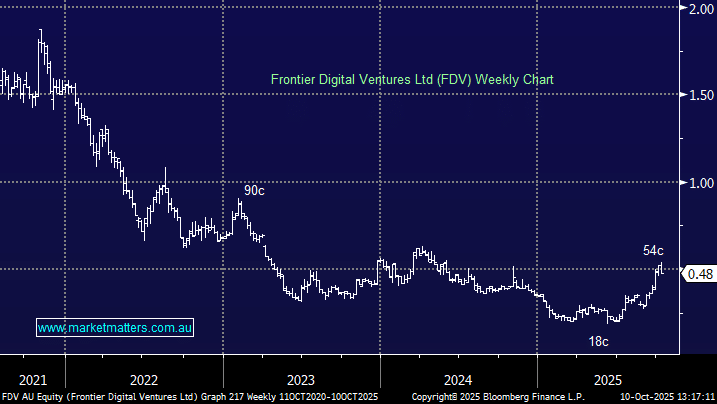

Frontier Digital Ventures Ltd (FDV) is an investment and operating company focused on building online marketplace businesses in emerging and frontier markets. Its main assets include property and automotive platforms such as Zameen (Pakistan), Encuentra24 (Central America), InfoCasas (Uruguay and surrounding LATAM markets), and AutoDeal (Philippines). FDV supports these businesses with capital and strategic guidance, aiming to grow them into dominant, transaction-focused digital platforms.

- In FY25, FDV’s consolidated entities generated revenue of $70.7mn and is forecast to reach $83.5mn in FY26.

- On its balance sheet, FDV held cash (or cash equivalents) of about $10.9mn as of June 2025; its total debt was minimal = a strong net cash position.

The companies ~$210mn market cap. seems reasonable although it obviously needs to turn these opportunities and revenue into profit. We like it as a small “speccy” around 48c.

Equity Holdings Ltd (EQT) – provides a range of financial and fiduciary services, primarily through its subsidiary, Equity Trustees. The company operates in two main areas:

- Trustee & Wealth Services: they offer services including estate planning and management, charitable and personal trust services, and wealth management and advisory services.

- Corporate & Superannuation Trustee Services: providing trustee, custody, and debt and securitization services for superannuation funds and other financial services.

The reason for the recent drop in the share price is in August ASIC initiated civil proceedings against Equity Trustees, alleging failure to conduct proper due diligence in overseeing investments in the collapsed Shield superannuation fund. The collapse affected approximately 5,800 investors, which will likely result in significant financial losses.

- Apart from the obvious uncertainty which markets hate EQT faces potential fines and regulatory constraints moving forward. It’s simply too hard for us ~$23.