Hi John,

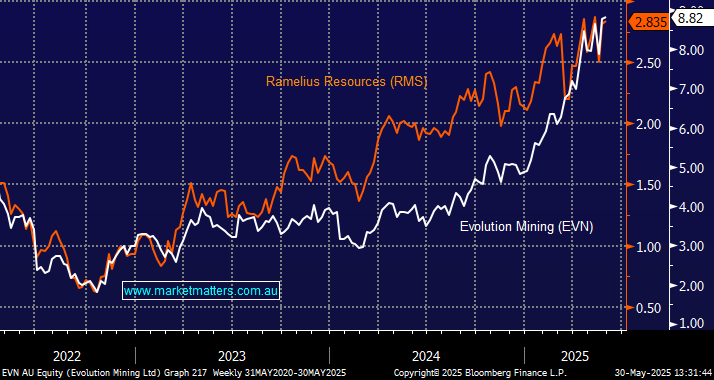

There is a couple of quality gold names on the ASX that could come under the same umbrella but obviously we cannot own them all. We have held a preference for EVN over others due to their operational turnaround in recent years. Historically, they had underperformed, however, they started to produce a greater level of consistency in their operations, and as we got evidence of this, we became more positive on EVN versus others, originally buying in the mid $1 range. So far in 2025 Evolution (EVN) is up +84% whereas RMS has advanced +49%, both great results but obviously at this stage of the year there’s one clear winner, which is pertinent considering 2025:

- Across the ASX the strong have got stronger through 2025 as the “Certainty Trade” remains in vogue

At this stage of the cycle, where MM is expecting some more choppy/volatile moves by the precious metal we would rather stick with the quality end of town but as we have discussed a few times of late if/when we get a correction in gold (a crowded trade) back towards $US3100/oz we will be considering higher Beta plays like Regis (RRL), or perhaps Ramelius (RMS).