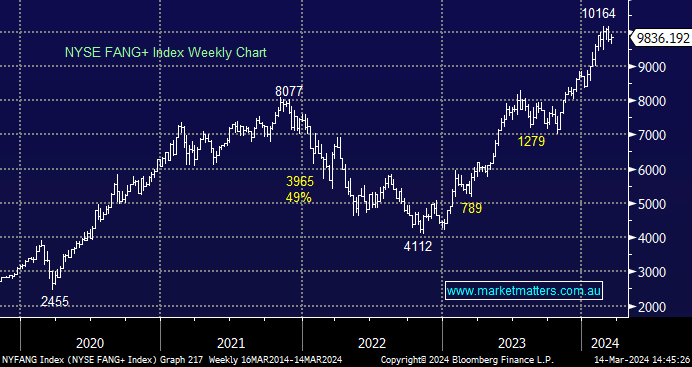

ETS’s – NDQ and FANG

Hey James and Team Thanks again for your excellent ongoing commentary I'm very bullish US tech ( for the medium/long term ) - the sensational six have all got strong growth prospects , with most investing a large percentage of their revenue in R&D . They have little or no debt , and dont look that expensive on a PE basis ( much cheaper than our local tech ) I currently hold positions in NDQ , and FANG , the latter being more concentrated. Do you think this is a good time to add, wait for a pullback, or average in? Difficult question I know Is there another way to increase my exposure to US Tech ? General advice only Many thanks