Hi Tony,

We touched on the VHY ETF in Friday’s report – read Here.

LEND provides liquid access to the private credit theme via a diversified portfolio of listed credit lenders. It’s aimed at investors seeking materially higher income than traditional bonds or vanilla credit ETFs, with monthly distributions, but it should be viewed as a higher-risk income allocation rather than a defensive substitute for more vanilla bonds. LEND yields more than 10% pa but this comes with plenty of risk in our opinion.

If investing in this space, we’d rather select managers we know, and then keep in close contact with them so see any changing in credit quality at an early stage – which is not possible when holding this ETF.

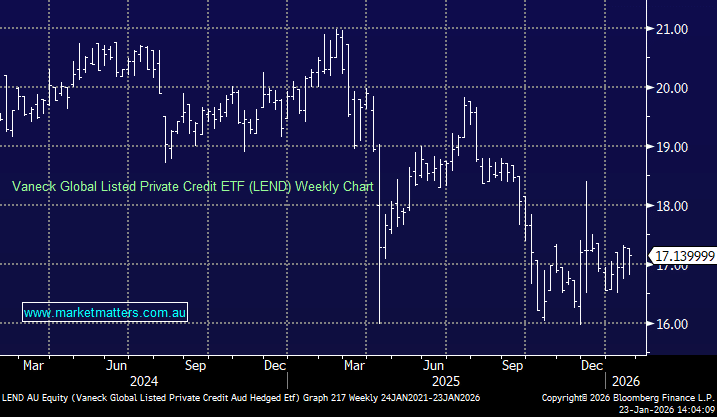

LEND has struggled over the last year as credit markets start to build in rate hikes, diminishing the attractiveness of the ETFs yield, but if we are correct and the RBA don’t hike twice this year ii should gain some support around $17. Not one for us.