Hi Graham,

Let’s look at these two income orientated asset classes:

- Term Deposit: A safe way to earn interest that generally pays a lower yield locked in for a specific time, with most term deposits currently paying ~5%, which is solid. The rate on offer at the end of this term will largely be dependent on the RBA Cash Rate at the time, so that is the variable.

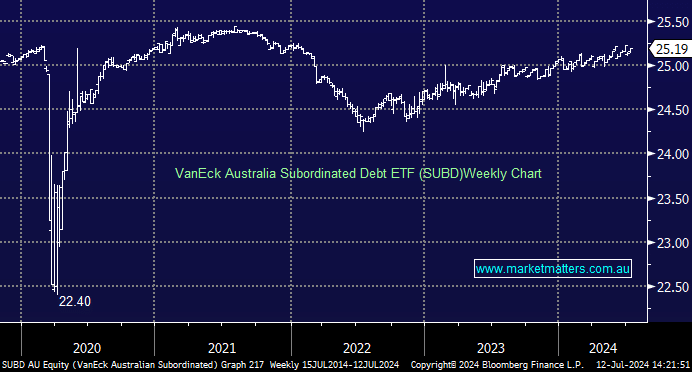

- Subordinated Debt ETF (SUBD) has yielded 5.7% over the last 12-months, however subordinated debt is higher risk being unsecured that ranks below other, more senior loans or securities with respect to claims on assets or earnings. In the case of the ETF it’s a bunch of them put together to smooth out the risk, and these are generally floating rate in nature, meaning the returns will move up and down with interest rates.

The main impact on the price of sub debt will be perceived risk which is shown through credit spreads. A credit spread is the risk margin that is offered over and above the safety of a government bond. If the market thinks risks have increased collectively, or specifically towards a particular issuer (corporate), then spreads will widen and the price of the subordinated debt will fall, causing it to underperform the safety of term deposits. Currently, spreads are low, which shows the perceived risk is also low.

The market is always about risk v return. Is the risk of holding corporate debt compensated adequately by the return offered. Right now, holding subordinated debt still makes sense to us, however you can see from the chart below during Covid how SUBD had greater volatility than a term deposit.