Hi Mark,

EROAD has been a pioneer in electronic RUC systems, having implemented the world’s first GPS-based RUC system in New Zealand. The company already collects over NZ$900 million in RUC annually from commercial fleets and heavy vehicles. With the expansion of RUC to include light EVs, EROAD is well-positioned to leverage its existing infrastructure and expertise to manage these new requirements efficiently.

NB RUC stands for Road User Charges, — a system where drivers pay for the actual use of public roads, typically based on distance travelled.

Road User Charges (RUC) in Australia feels inevitable as fuel excise revenue declines with EV uptake. This shift could benefit companies like EROAD, which already manages RUC systems in NZ and could support similar systems in Australia.

- For FY26, management has guided a minimum revenue of NZD 205 million and ARR (Annualised Recurring Revenue) of ~NZD 188 million, implying ~5–7.5% top‑line growth.

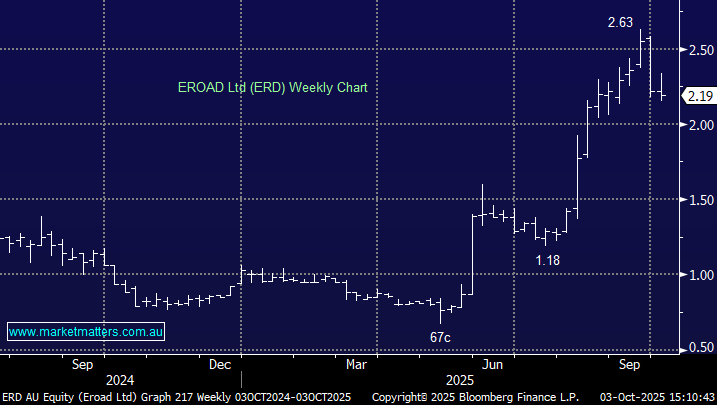

The stocks priced for growth, having only delivered NPAT of NZD $1.4mn in FY25, but it’s well positioned to deliver. We like the stock in the $2.10-2.20 region targeting an eventual foray up towards $3.