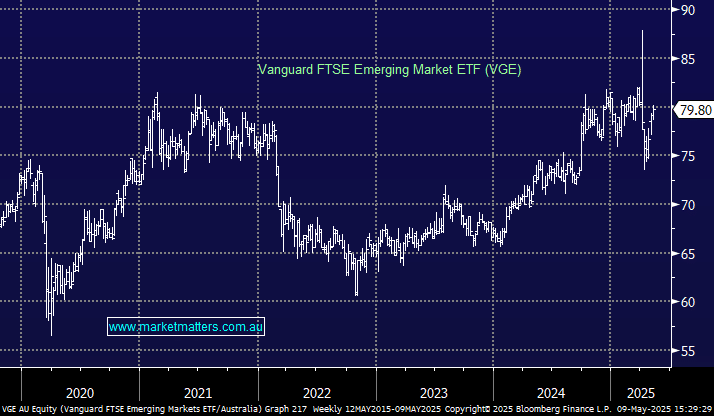

Vanguard FTSE Emerging Market ETF (VGE)

Hi, I’ve been exploring investing in India and was thrilled to get a call from you about a recent question I had running it to Easter. Thanks so much. Following your comments , I looked at the spread of investments in some of these ETFs so as to give me exposure to India, and thought the spread in Vanguard Emerging Markets Fund (VGE) gave a good spread with a a mix of India, China and USA. I’d appreciate your thoughts on this ETF from a spread of markets viewpoint and how that compares with others. I don’t think it’s in your ETF Portfolio? Thanks so much