Hi Mark,

We have in the past held both Chrysos Corp Ltd (C79) and Austin Engineering Ltd (ANG), but we don’t at present.

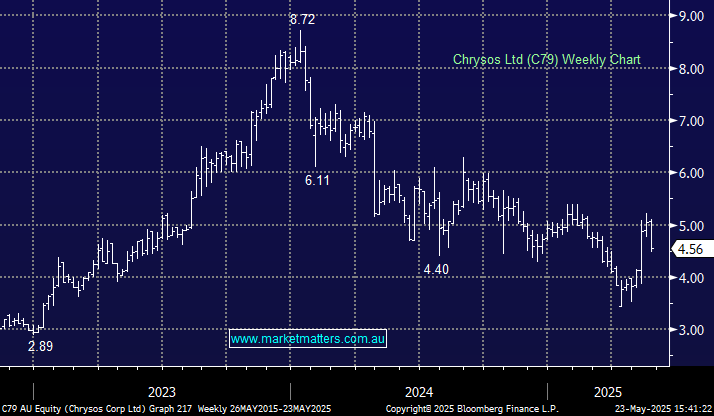

Chrysos Corporation (C79), is an Adelaide-based mining technology business, with a cutting-edge gold assay technology. As you rightly point out, the company has entered into a significant partnership with Newmont, the world’s largest gold producer, which is a major step forward. The key now is about getting more units on sites around the globe. They have previously missed their forecasts around deployment, and we lost some confidence in their ability to deliver on guidance. That said, they have a great product, that saves companies time and money, they are growing their customer list, and more units are being deployed. We like the stock, but we just need to see several periods where they meet targets to get confident enough to buy it again.

- We like the implications of this deal with C79 looking interesting back around $4.55, well below where we exited last October – its back on the MM radar.

Austin Engineering Ltd (ANG) is a global manufacturer of mining equipment such as truck trays and buckets that we sold out of initially at 64c then cut the balance at 52c. The stock has come back to 38c as its faced several challenges in recent times, which has led to the stocks more than 40% correction:

- In the first half of FY25, earnings (EPS) declined to 1.7c from 2.5c in the same period of FY24. This decline has raised concerns about the company’s ability to sustain its growth trajectory.

- Also this month saw the arrival of a new CEO and Managing Director.

At this stage we would call ANG as a “wait and see”, though we do find it interesting again, once we get a better understanding of the new CEO’s priorities.

Elsewhere, while we don’t own it currently, we do like Ive Group (IGL), which is a printing business.