ECRD and the AI tech wreck

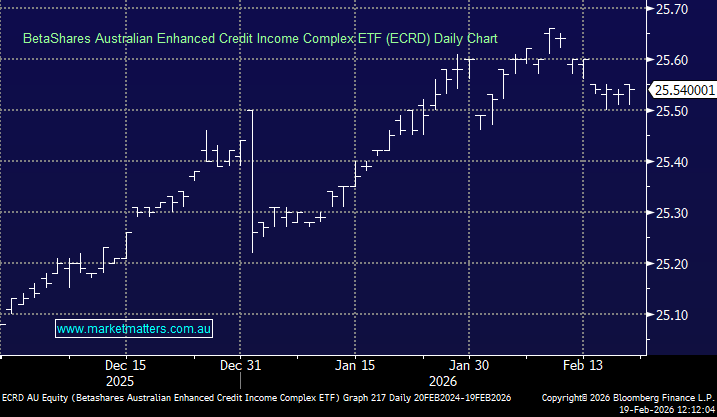

James and Team, I've tried and been courted by many research providers / houses but nothing has come close to the service MM provides and I have done very well following your advice and will continue to be a member for a long time. I have two questions, first one is the new Income ETF ECRD . It is quoting a yield above 7s with a credit rating of A-, what is your view of this new product. It seems very generous when you consider the ASX dividend yields. Do you have a view on the risk of this product. Second is the AI tech wreck we have seen in the last week. After trumps tariff calls last April buying the dip paid great dividends particularly with tech, but now seeing WTC at under $50 and PME at $118 it should scream buy given their historical levels. Forgive the naivety, now 10 months later, is this threat of AI destroying SaaS business models, breaking long term contractual businesses relationships and years of R and D as real as it seems or has the fear overtaken the reality. Thanks