Hi David,

DRO is all about the future not the past, revenue was small in 2022 but its forecast to increase significantly over the coming years:

- $16.9mn in 2022, $55.1mn in FY23, and $57.5mn in FY24.

- Moving forward it’s expected to generate $213.5mn in FY25, $308mn in FY26 and $387mn in FY27.

- Ongoing growth in revenue should lead to higher earnings and a lower PE in time.

- On consensus profit estimates of $37m in FY25, DRO’s PE is 109x. On consensus FY26 numbers, DRO’s PE is 69x and 47x by FY27

NB DroneShield’s is a Dec year end, so we’ll get FY25 numbers on the 25th Feb

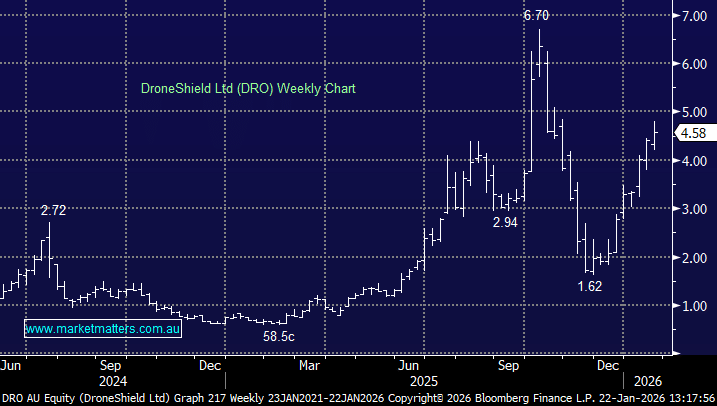

The last year has been an enormous emotional rollercoaster for DRO investors, aided by massive lifts in global defence spending and contract wins by DRO but offset by “mixed” messaging from a number of insiders.

- We are not fans of DRO from an investment perspective but it’s a great trading vehicle when you get it right.