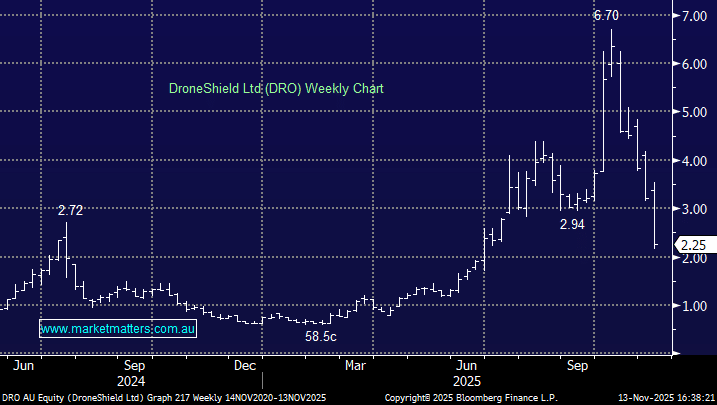

DroneShield Ltd (DRO)

No doubt I won't be the only one this week. What the f**k is going on with Droneshield? Even in spite of their 10th November announcement gaffe, the company is still winning contracts with more in the pipeline. Why have they been sold off so heavily? - David I am a seasoned SMSF Trustee with a reasonable portfolio and years of trading experience so I am used to the machinations of the share market. However, as a DRO shareholder, one event has completely rocked me, and that is the sell down of Droneshield (DRO) shares by Directors of the company - AFTER HOURS!! I quote - "Droneshield disclosed three director transactions at 7:18 pm, 7:20 pm and 7:21 pm last night, including: Non-Executive Director Jethro Marks disposed 1.46m shares ($4.8m), representing his entire shareholding (ex-unlisted and vested performance options) CEO Oleg Vornik sold 14.8m shares ($49.4m), same pattern as Marks and only holds (193k+709k unlisted and unvested performance options) Non-Executive Chairman Peter James sold 3.68m shares ($12.3m), also same as the above My understanding is that in Australia between 4.10pm and 5pm, there is the ‘Adjust‘ phase. There is no trading allowed, but brokers are allowed to amend orders or cancel unwanted orders. This is nonetheless a distinct phase from the ‘Close’ phase that kicks in formally at 7pm when even this is not allowed to take place" To add salt to wounds of "ordinary" shareholders, at 12 midday the following day, DRO is down 33% - quite a handy after hours sale wouldn't you say!! A good call by Directors? A coincidence? Unfair advantage? Can you please explain how this happens? Brian Droneshields 30% drop in a day? What is the reason for this and when something like this happens, where can I find information on the member's site? Thanks Rosyln Just interested in your views on Droneshield given the recent sales by Company Insiders. Is DroneShield a Buy? Jeremy.