Hi Alain,

There are many factors that will influence the price of gold which Peter and I discussed in the video:

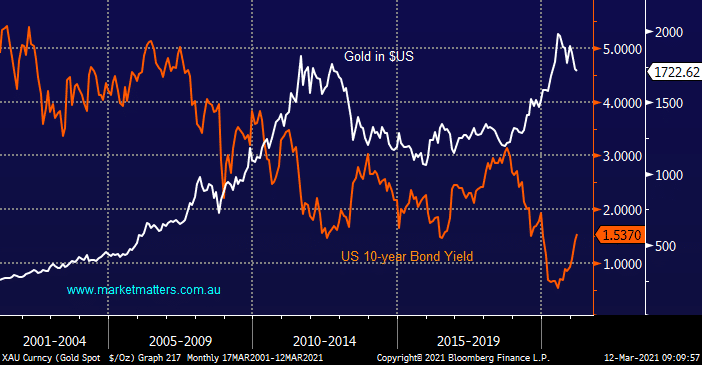

Gold generally moves in the opposite direction to interest rates because investors who hold gold are foregoing the yield from cash in the bank but also its got the reputation as being a great hedge against inflation and volatility, both of whom we expect to rise in the years ahead.

However our foray into the sector this week was primarily motivated by MM’s view that bond yields have rallied too far, too fast, and a decent pullback was likely which should help gold recover towards $US2,000/oz, we don’t expect this to be a long-term position.

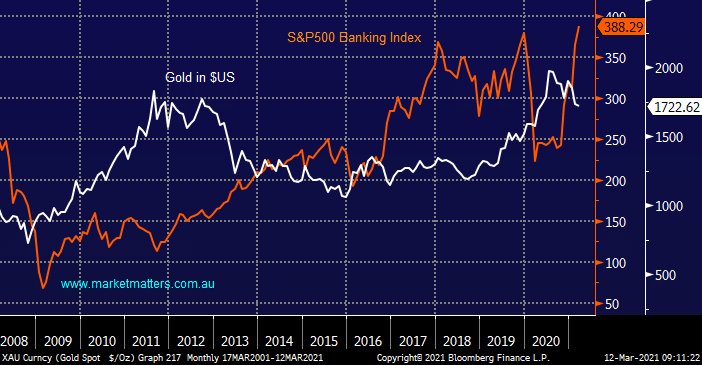

Unlike gold banks love rising bond yields because it flows through to increased margins, hence the sector both locally and overseas has boomed in 2021.