Hi Chris,

DGT its essentially a specialised property trust — similar in structure to traditional REITs — but instead of owning office towers or shopping centres, it owns data-centre assets and associated digital infrastructure (power, cooling, fibre, and land). They operate SYD1 in Sydney, which is their flagship Australian site undergoing a large expansion, as well as US campuses in Virginia and Texas, targeting hyperscale clients. DGT also has a pipeline of early-stage development sites with power and land secured.

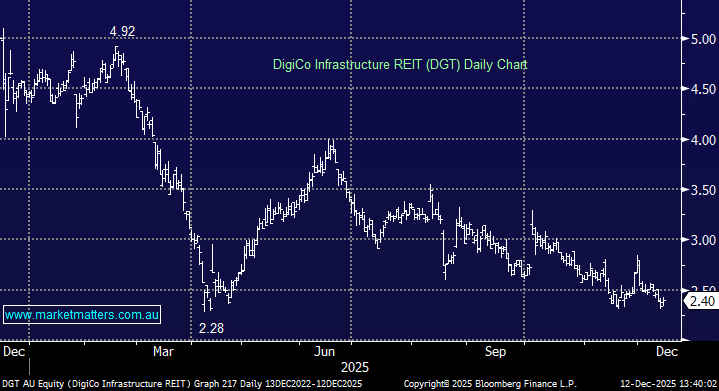

- The stock has more than halved since its much hyped float this time last year.

However, we should also be cognisant that others in the space like Goodman Group (GMG) and NEXTDC (NXT) are also trading well off there highs, both by around 25% respectively. The data centre space has gone from hot to cold in the last year, a common cycle when new industries boom but we believe in the AI Trade with the real question being what’s fair value for assets like DGT now the hot air has been let out of the space.

- We like DGT below $2.50 aided by its ~4.6% yield but it may take some time for the sector to regain its footing – its as cold today as it was hot in 2024!