Deterra (DRR) for franked income.

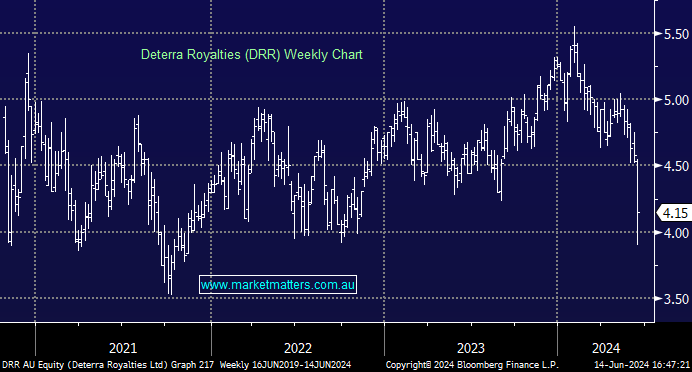

I placed a question on Deterra this week but since then DRR has made 2 relevant announcements. Offer by DRR to purchase all Trident Royalties plc units on UK AIM Market for cash at 22.5% premium to market price. DRR announced an adjustment to its dividend policy within its existing capital management strategy balancing shareholder returns and capital growth. This will reduce minimum div payout from 100% to 50% to fund future investments. I see that DRR share price has reduced from 4.73 at 3 June to 4.46 13 June.