Defence ETF’s

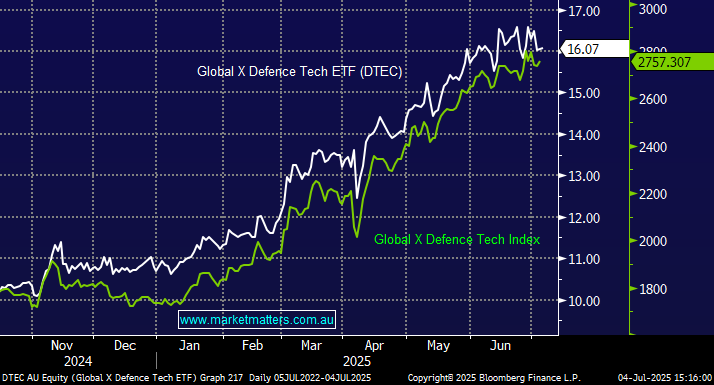

Interested in your view on defence ETFs including ARMR, DFND and DTEC, maybe there are others. They have had a good 2025, do you think they will continue to perform with the defence spending that is getting committed by various countries. Adrian Greetings MM team, Love your efforts, keep on trucking! Increased defence spending across the world has become one of the Big Ticket items across the world. So where do we invest to be part of expenditure investment & returns? Are there any ETFs available? Thx Glenn