I think the takeover of DCN looks poor, agreed?

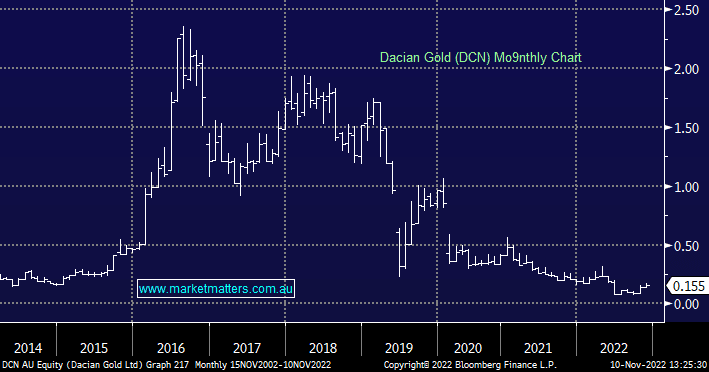

Dear MM I have had shares in DCN for a long time. They are currently worth half of what I paid for them after having been worth well over what I paid for them not so very long ago. Genesis Minerals Limited (GMD) are in the process of taking them over. As per below they have offered 0.0843 GMD shares for every DCN share. My 88,673 DCN shares are currently worth $12,414.22 at $0.14 per share. By my calculations if I accept the GMD offer I will have 7,475 GMD shares which at the current price of $1.17 will be worth only $8,745 (if my calculations are correct ???). According to the information that they have provided (in italics below) it won’t be very good for me if I hang on to my shares and it seems the only option is to sell them. They have been bombarding me with emails and letters trying to get me to accept their offer, and I’ve even had someone from the company phone me. The DCN board appear to be supporting their offer. I know you can’t advise me whether to sell but would appreciate your opinion as to whether the following information from them suggesting I’ll be much worse if I don’t accept their offer looks realistic or just scare tactics. “Genesis declares its Offer of 0.0843 Genesis shares per Dacian share best and final as to consideration. There will be no increase in the number of Genesis Shares offered for each Dacian Share under the Offer. Dacian shareholders who do not accept the Offer prior to the close will not receive the scrip consideration under the Offer, unless Genesis is entitled to proceed to compulsory acquisition (in which case they will receive the consideration, but at a later date than if they accepted the Offer). Dacian shareholders should be aware that if Genesis is NOT entitled to proceed to compulsory acquisition, and Dacian continues to be listed on the ASX following the Offer, then the decrease in the number of Dacian shares available for trading may have a material adverse impact on their liquidity and valuation. Furthermore, depending on the level of acceptances received and other considerations, Dacian may apply to de-list from the ASX, in which case it may become more difficult for Dacian shareholders to sell their Dacian shares. Dacian shareholders who do not accept the Offer prior to the close will not receive the scrip consideration under the Offer, unless Genesis is entitled to proceed to compulsory acquisition (in which case they will receive the consideration, but at a later date than if they accepted the Offer). Dacian shareholders should be aware that if Genesis is NOT entitled to proceed to compulsory acquisition, and Dacian continues to be listed on the ASX following the Offer, then the decrease in the number of Dacian shares available for trading may have a material adverse impact on their liquidity and valuation. Furthermore, depending on the level of acceptances received and other considerations, Dacian may apply to de-list from the ASX, in which case it may become more difficult for Dacian shareholders to sell their Dacian shares.” Would be very appreciative if you could give me your opinion on this. Regards, Peter