Hi Richard,

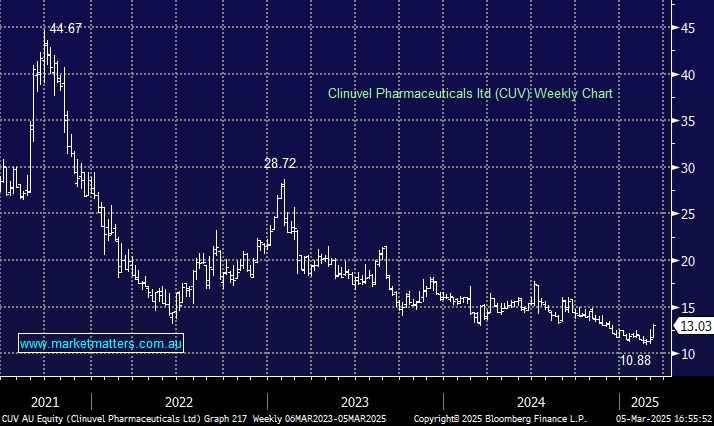

This high Beta biotech stock has been under pressure for a few years having tumbled ~75% from its 2022 high, albeit with a few bounces along the way. At the end of February, CUV posted revenue of $35.6mn, up from $32.3mn YoY, and earnings per diluted share of 28c, up from 21.2c YoY – a decent beat to expectations. .

As you mentioned, the stock rallied sharply on Wednesday after introducing its “Groundbreaking” Vitiligo Program at the world’s largest Dermatology meeting in the US, although its Phase 3 Trial for SCENSSE and NB-UVB Light have been delayed by ~ 12 months. Importantly, this stock has experienced similar gains 5 times in recent years before falling away, i.e. its not for the fainthearted.

- We think CUV looks ok as an aggressive play, but we would use stops under $11.00, given it remains in a downtrend.