Critical minerals manipulation?

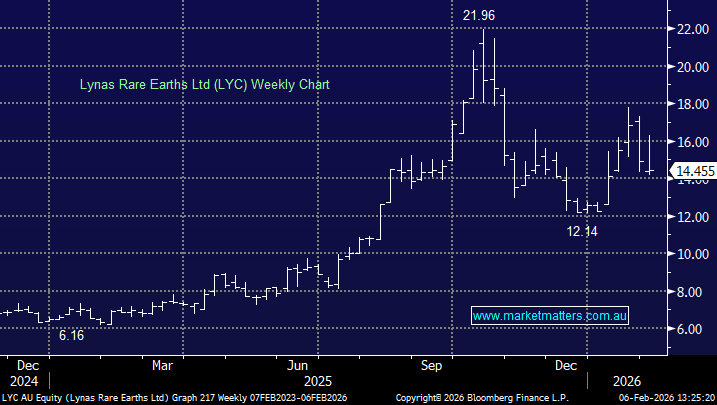

So, as far as I can figure, this whole rout in the critical minerals market has less to do with investor behaviour and more to do with global price and supply wars, given that they can determine who dominates the defence, technology and AI spaces. If that's the case, how are these equity valuations ever going to recover and why would you 'buy the dip'? Further to that, for all the chart watchers, did any of them indicate that this rout was imminent?