Hi Bill,

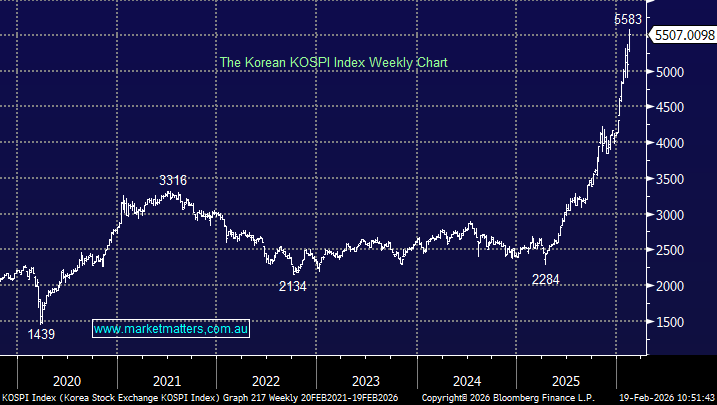

Youve certainly called the move in Korean stocks extremely well, congratulations!

We don’t agree with the article which is “blaming” autocallables (structured products) that generate a yield by selling volatility as being responsible for the last years surge higher by the Korean Kospi although they may have accelerated the move at times as the related stocks/index continued to go from strength to strength. In the bigger picture markets are driven higher by earnings and that’s the case with the Korean market:

- Samsung Electronics and SK Hynix make up a whopping ~30% of the KOSPI.

Both of these stocks are memory chip manufacturers where prices have risen sharply over the last year as AI data-centre demand outpaces supply:

- DRAM prices have surged by roughly 55–95% year-on-year, with some contract forecasts showing particularly strong increases as AI build-outs drive tight supply.

- NAND flash prices have also climbed significantly — commonly up 30–60%+, with some indicators suggesting structural price pressure well into 2026.

We shouldn’t forget that over the same time frame US giant Nvidia has also enjoyed stellar gains. While data centres get built at a rapid rate the Korean market should flourish although we feel a fair bit of the good news is already built into these stocks and the market.

Importantly, this is a very concentrated bet. Clearly it’s been a good one, but always be conscious of balance, knowing that things can come from left field.