Hi Josh,

An interestingly worded, very tricky question because we don’t yet have all of the relevant facts, although what we know sounds awful. CTD is now facing its existential crisis – a potential tailspin from which it will be difficult to pull out. What we know:

- In August CTD went into a trading halt / after the company revealed it had discovered “significant financial reporting errors” in its European operations.

- The misreporting may stretch back over multiple years which is concerning on many levels.

- Last week the company revealed it overcharged its UK customers by $162mn which it now needs to refund.

- This week Corporate Travel Management was belatedly hit with a “please explain” note from the Australian government, whose travel management contract it looks after and is up for renewal in 2027.

CTD’s revenue in FY25 was $700mn hence these are meaningful hits to the companies’ financial position and ongoing income/profitability – it will be a brave public servant to renew contracts with CTD in the coming years.

This heighted concern hasn’t come from out of the blue. There have been previous red flags about accounting treatments employed by this company going back almost a decade.

In 2018, it was hurt by what finance lingo calls a “short attack” when a hedge fund issued a scathing report on the company accusing it of aggressive accounting and “phantom” offices.

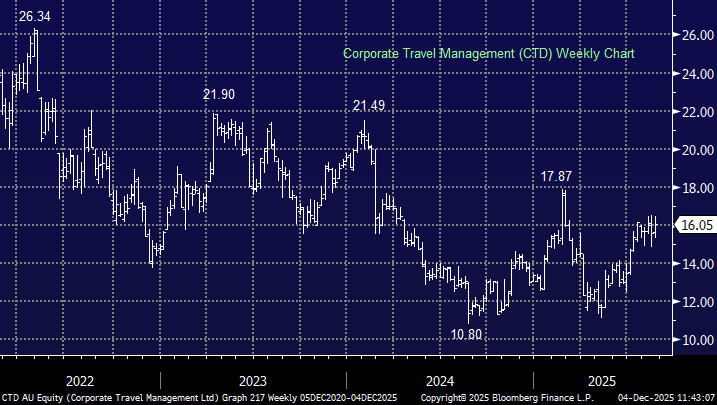

The shares have been in a trading halt for over 3-months illustrating the seriousness of the issue, we certainly wouldn’t consider buying the stock as it reads today ~$10. This could take years to recover if it comes back onto the market at all – clients will likely walk on mass. To us CTD, is all too hard, there’s a good chance it will be a very different business in 2026 than it started this FY, and it may not even trade again…