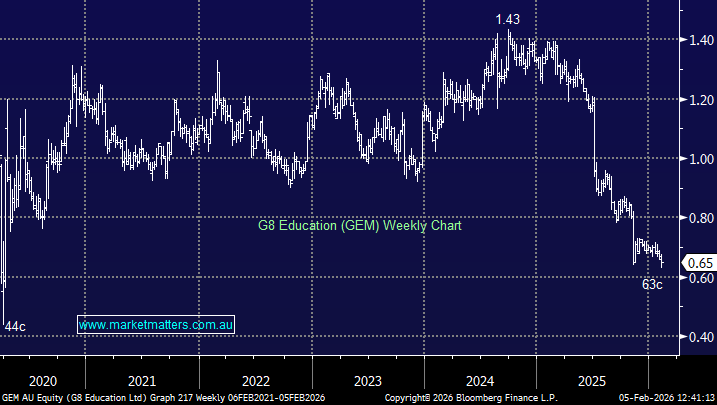

Child care stocks – G8 Education (GEM), Embark Early Education (EVO), and Mayfield Childcare (MFD)

Hi guys, Thanks again for your great commentary and analysis. The federal government removed the activity test from Jan 1, 2026, for eligibility to childcare subsidies for up to 3 days per week. Now any parent - regardless of income - can receive subsidies without having to work, study or look for a job. This creates a fairly strong tailwind for ASX listed childcare stocks, I would have thought. With these stocks being in the doldrums at present, does this provide a catalyst for a re-rating for some/all of these companies? Could you provide your analysis of this sector and the individual companies please. Cheers, Stuart