Hi Nick,

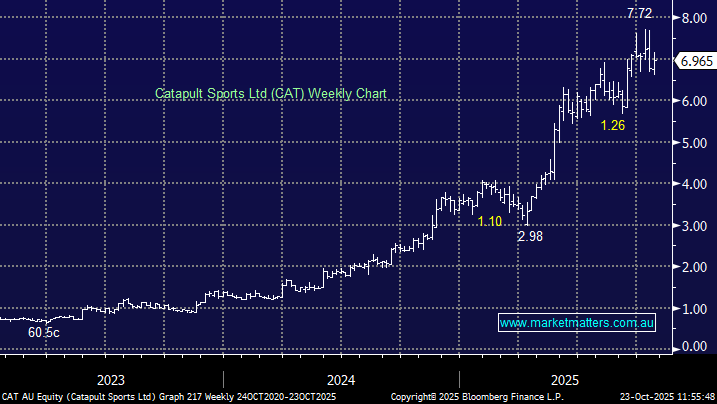

Catapult Sports (CAT) remains a stock/business we like at MM having been long in our Emerging Companies Portfolio since 2023, with the position currently up close to +400%. The stock has evolved from an illiquid small cap to a widely held and discussed $2.1bn global growth stock that has now entered the ASX200.

The company recently announced a $130mn capital raise to fund the purchase of soccer analytics firm IMPECT GMBH for Euro78mn with as you say the SPP at $6.68, approx. 4.5% below where it was trading on Thursday. By definition after the stock’s appreciation, we now have a significant weighting of CAT in our EC portfolio. Friday was a goood day for CAT, and our intention here is to trim our holding next week, leaving room to increase again in the SPP if a greater than 5% discount exists nearing it’s close at 5pm on the 5th November.

The DMNHA is a listed floating-rate note from Dominion Investment Group, paying monthly interest at 1-month BBSW + 3.00% p.a. on a $100 face value. It’s an unsecured, subordinated debt security with an optional call date on 9 October 2031, and if they are not redeemed then, the maturity date is 11 October 2032.

- We believe DMNHA is a buy below issue price, given the call structure and the diversfied nature of their holdings, run by a good manager.