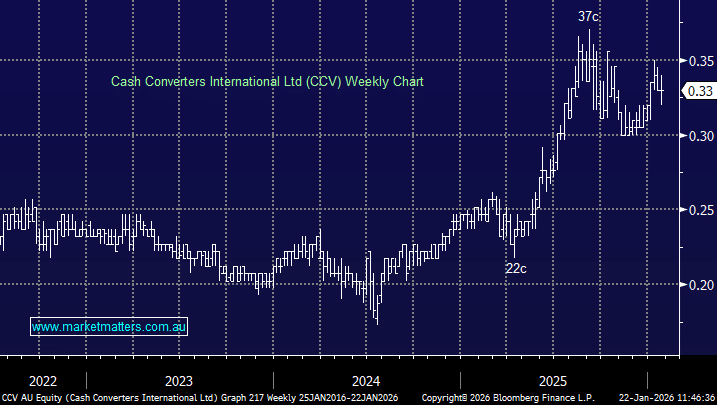

Cash Converters International Ltd (CCV)

Do you have a view on CCV? I find it an interesting 'roll-up' story with a positive twist. They have just finished a cap raise to buy out franchise stores at around 3-4X EBITDA when CCV is currently priced at about 8x EBITDA. However my understanding is that the franchise stores use the same software and thus CCV have full transparency of annual sales of each store they are acquiring so should be able to accurately determine the profit add-on for being a company owned store. So a current 6% FF yield with improving profits from more coy owned stores and hopefully an acceleration of share price if business continues to be priced at 8X EBITDA. Thoughts? Cheers David