Capital notes v cash

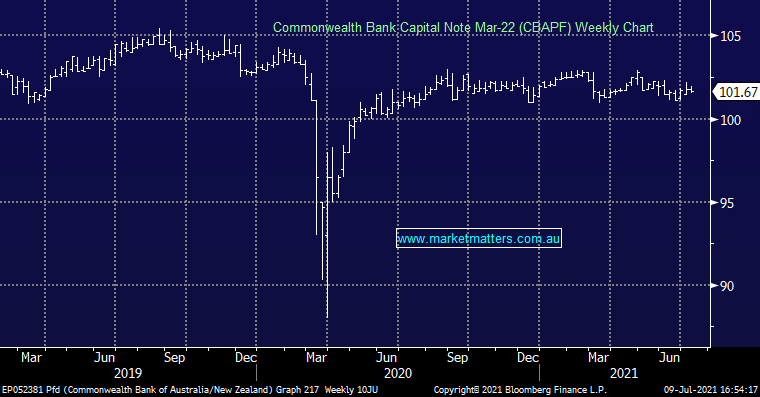

Hello Market Matters, I’m hoping you can offer me some thoughts in couple of matters. We've just setting up a SMSF, I would like to try a different trading platform as I’m not really happy with ANZ. We need a platform that is happy to trade in the US etc. as well as Aust. (1) Do you have any thoughts or have use heard good reports on any platforms?(2) A friend has converted the cash component of his portfolio into Capital bank notes to get a better return, he says they are secure and he's getting around 5% return paid quarterly. He has them in the 4 major banks. Could I have your thoughts on this strategy, and what the risk is. Thank you Regards John (ANOTHER MARKET MATTERS HAPPY CAMPER)