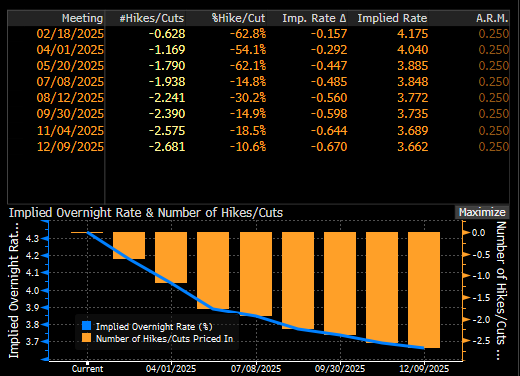

Calculating the odds of interest rate cuts/rises

Hi I frequently see comments on MM and in other media like this one that was in Monday's report :"By Friday’s close, futures markets were pricing a 53% chance of a cut in February and an 89% chance in April" Can you please explain how analysts and "the market" arrive at these percentages for the odds of interest rate movements? Regards, Carl