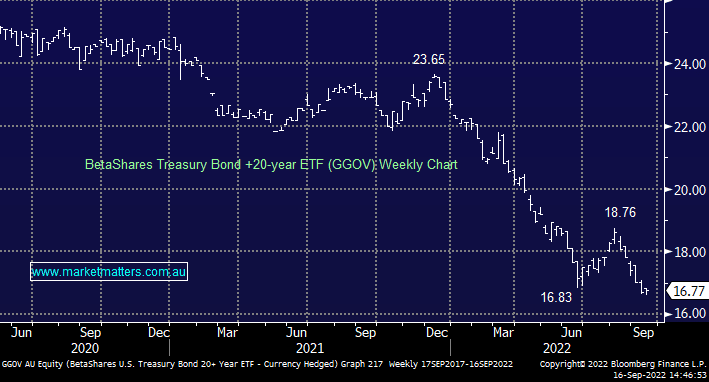

Are MM pushing volumes in the GGOV ETF?

Could you please elaborate on this recommendation as I note the price has been declining since the start of the year. Also market depth is limited with daily trades less than 5,000 shares although there is a spike today (14/9/22) which could be due to purchases by Market Matters subscribers.