BOE vs PDN

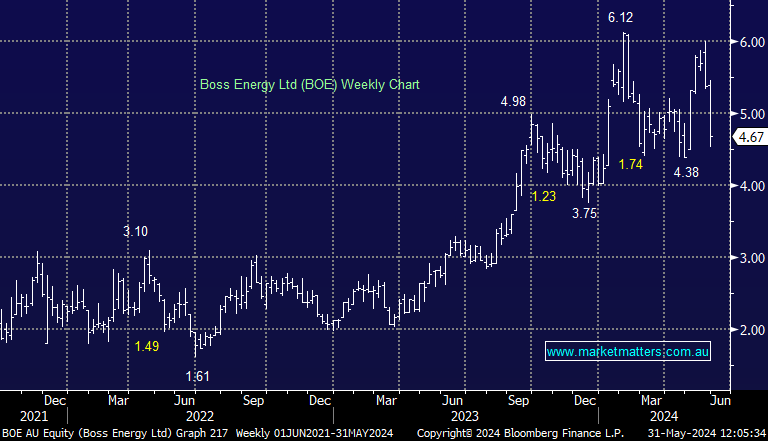

Hi MM, Following the BOE director sell-down, BOE has, to date, had a greater fall from its recent highs than PDN. Given this, notwithstanding that you have said many times that PDN is your preferred uranium play out of those two producers/near-producers, is there a scenario in which you would buy BOE instead of PDN (or perhaps ultimately some of both, with BOE first) if the BOE price continues to fall - both in general and relative to PDN? I assume that BOE is not an "Avoid" altogether and, at a particular price point, MM would be quite interested but obviously I may be wrong on that point. Also, given the extent of the director sell-down, is the BOE share price currently holding up better than you would have expected - and are you still leaning towards further falls/weakness? Thanks, Darren