Hi Ian,

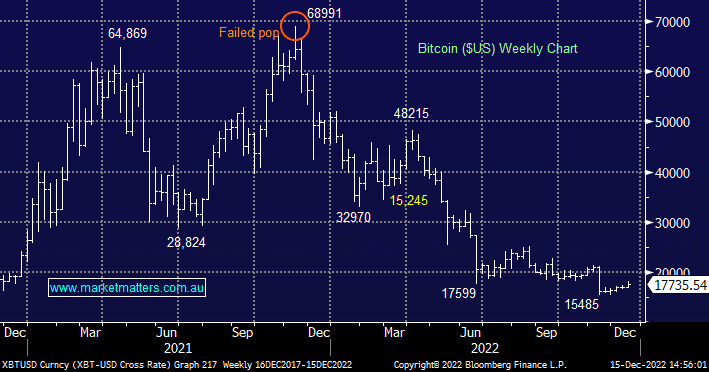

Like you MM is glad to have avoided the crypto space over the last 12-months, as we’ve written over the last few months technically Bitcoin looks interesting into weakness towards $US15,000 but its still not for us. Moving onto your specific question:

1 – Bitcoin is not directly impacted by the FTX collapse but a lot of buyers/speculators in crypto currencies have lost huge amounts of money damaging both sentiment and by definition demand as they’re $$ to buy the currencies has vanished into thin air.

2 – If we were looking to gain bullish exposure to Bitcoin / crypto currencies we would look at the BetaShares Crypto Innovators ETF (CRYP), the locally traded CRYP ETF is designed to track 50 of the largest global companies involved in servicing crypto-asset markets which should provide a degree of insulation against “specie blow-ups” while holding an asset which historically tracks the Bitcoin price closely.

3. To invest in Bitcoin directly means doing so through an unregulated exchange – dangerous as we saw with FTX, although it seems clear there is likely some criminality involved here. Independent Reserve is an exchange here, however we have no insight into how this is managed.