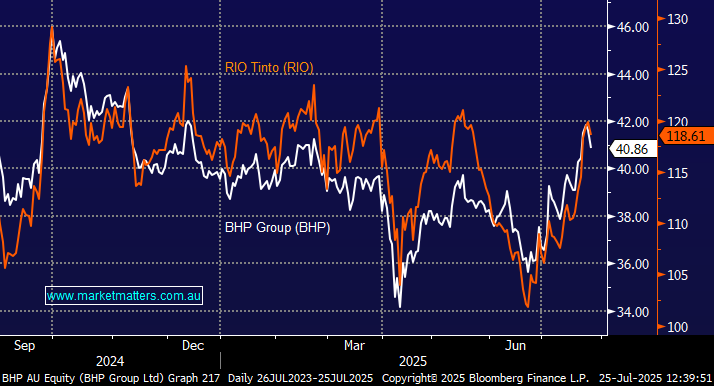

BHP Group (BHP) vs RIO Tinto (RIO)

I appreciate that this question has been asked many, many times but please help me understand why BHP is so heavily preferred over RIO? Is it a bias or am I missing key info? In trying to get clarity I keep bumping my head against the following details RIO's share price appreciation outperforms BHP - over 1, 3 and 10 years. RIO's metrics are pretty similar to BHP's when one compares the LSEG stock reports. RIO pays a slightly better dividend 5.2% v 4.6% RIO has Simandou and Oyu Togoi in the pipeline so Fe ore and Cu are debatable (51% v 55% ; 16% v 25% with imminent changes). Then on a smaller scale RIO has Aluminium vs BHP's Ni and coal. In looking at Resource ETFs , they hold a higher allocation of BHP to RIO. Why? And for full disclosure I also hold both in a similar ratio to the ETFs. What am I missing? Why BHP over RIO? Thanks and regards, JanP