Hi Andrew,

Thanks for the feedback, it was a fun month!

For those needing some insight to Beta, a beta less than 1 indicates the stock is less volatile than the market, while a beta greater than 1 suggests it’s more volatile. A weighted portfolio Beta looks at all positions held, the weights they are held, and gets the weighted average (beta) of the portfolio i.e. how the portfolio should perform relative to the market at that time.

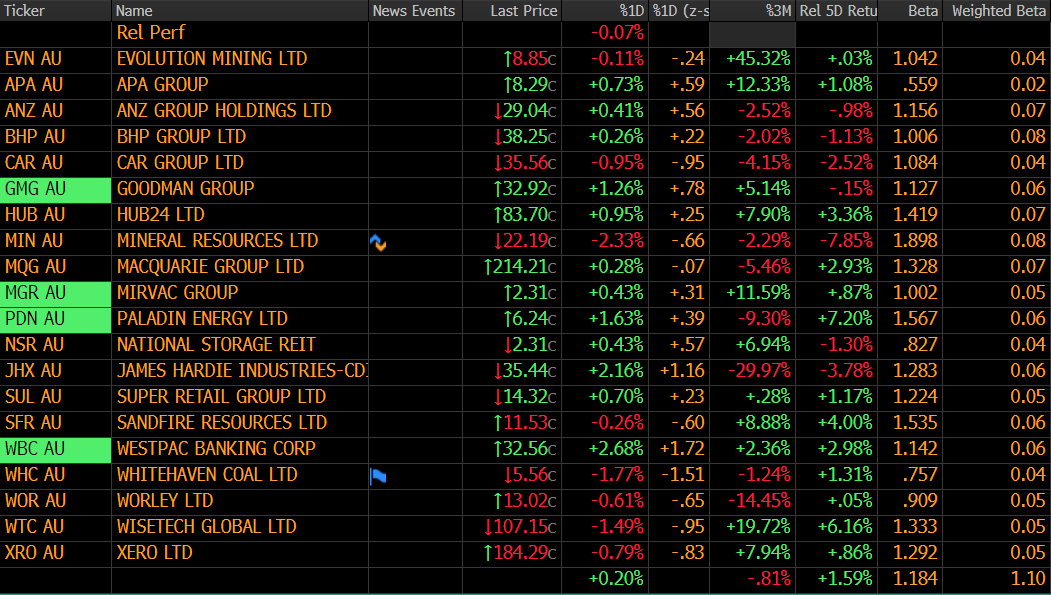

We do track the “weighted beta’ of our portfolios. The Active Growth Portfolio for instance has a current weighted beta of 1.1x – as shown in the last column in the portfolio below. We often refer to migrating up and down the “risk curve” and we use beta as a guide to this. Conservative stance ~0.8x beta, up to a 1.2x is the general range we think about. The Active Income Portfolio has a more conservative beta around ~0.6x currently.