Hi Jan,

Regarding recession, I think that we’re probably there already, particularly in the US and in any case, when a recession is officially called, the market is nearer the low. Banks generally struggle in a recession as bad debt rise, a result of people losing their jobs and not being able to service mortgages & other debts. This recession would be different, a lack of workers is creating a headwind for growth while household savings rates are very high, with the majority of home owners well ahead on their mortgages thanks in part to government assistance through Covid.

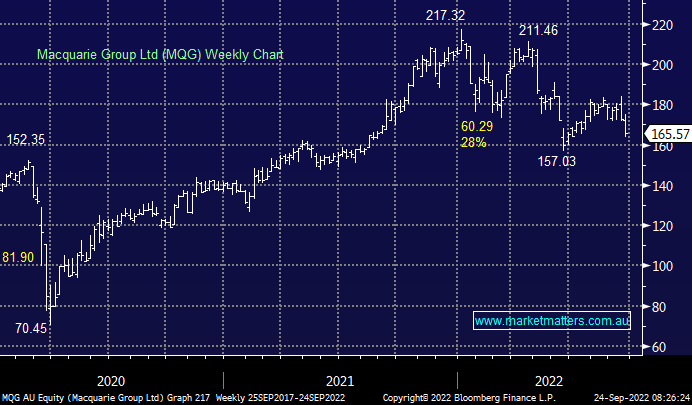

Banks themselves are incredibly well capitalised and we’re certainly not entering this period following a time of huge excess & easy credit. Those are the positives, one of the biggest negatives would be asset values which generally come down during a recession and Macquarie is most exposed here. Because we are net buyers of stocks into weakness, we prefer to stick with the more market linked play in Macquarie (MQG) at current levels, however we do see ourselves buying NAB as well into further weakness given we have some cash up our sleeve. MQG is a higher beta stock than NAB which means it will have greater moves relative to the market on both the upside & downside – it’s higher risk in other words.