Bank Hybrids

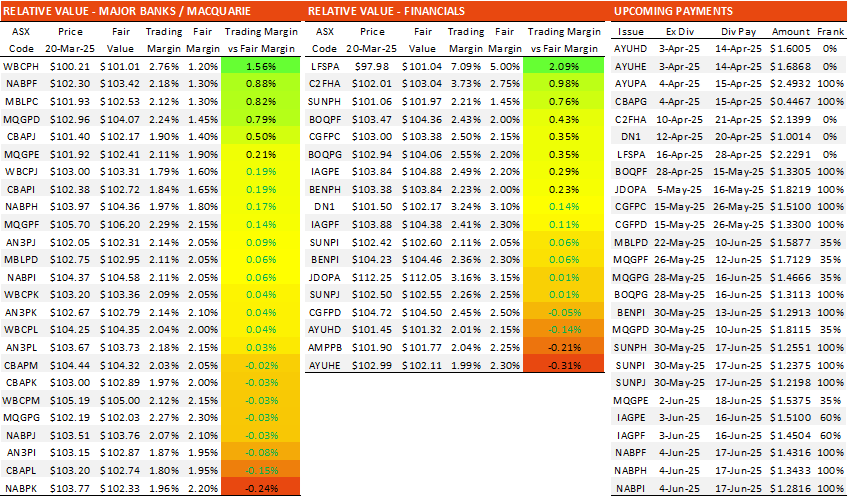

Hi, I’d b interested in your comments on the fairly slow withdrawal of bank hybrids eg WBCPL @9/28 thru to NABPK @ 3/32 with coupons ranging from3.4% to 2.6% & all 100% franking: Also non bank less regulated hybrids eg CGFPD @3.6%, SUNPJ @ 2.8%, IAGPF @3.2% 60% franked Also the odd commercial hybrid RHCPA @4.85% fully franked. Thanks, Regards Craig