Bank Hybrids

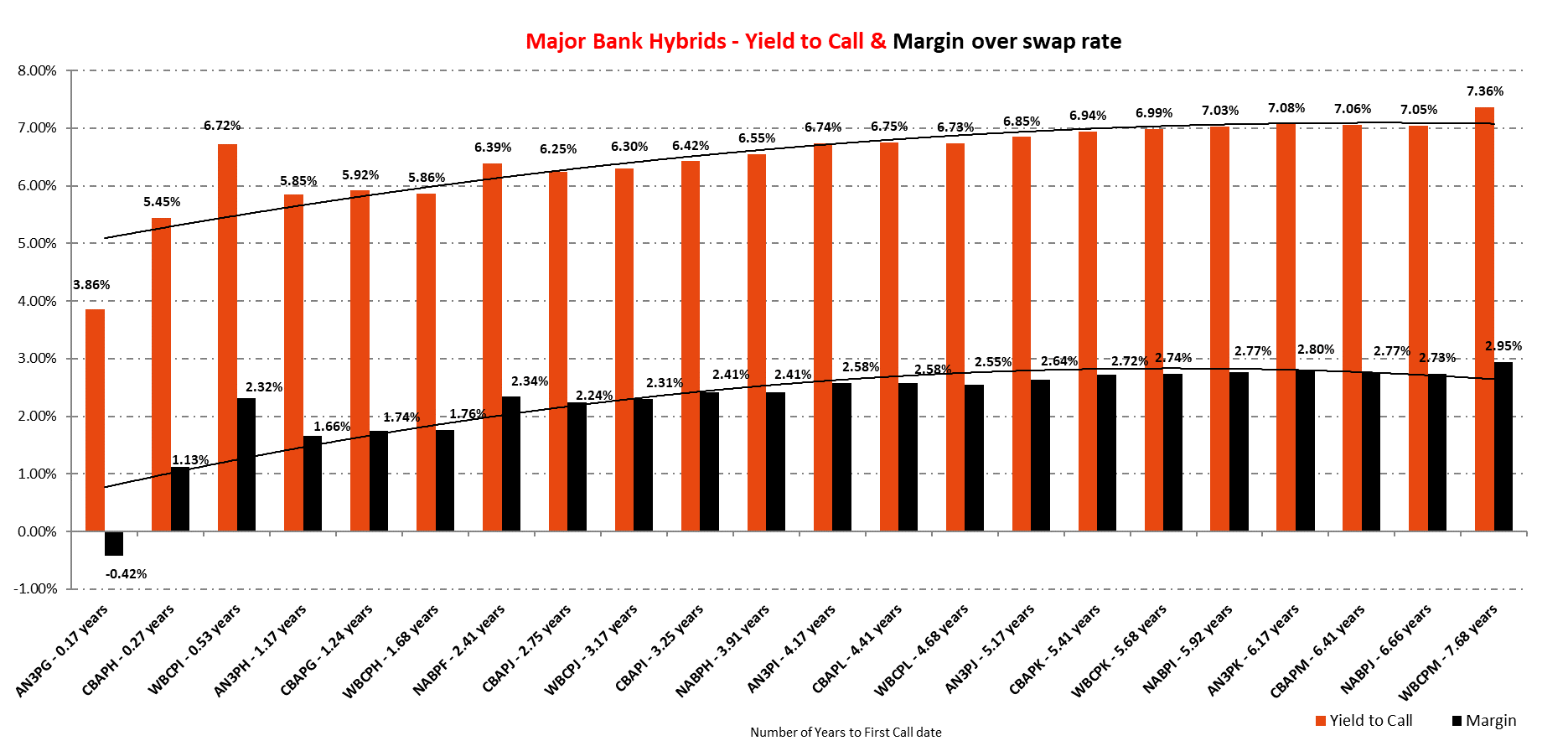

Hi James Thank you for helping us through a volatile year in 2023. You have a number of Bank Hybrids in the Income Portfolio . Could you advise what is your strategy for Buy and Sell? Apart from Buying the issue @ $100.00, what indicators do you rely on? Are you intending to hold to First Call date? When would be the ideal time to Sell as the Market Price declines as duration approaches First Call date and Maturity What factors would cause a Sell?