Hi Scott,

Axon Enterprise (AXO US), Meta Platforms (META US), and Coinbase Global (COIN US) – three very different companies from law-enforcement technology to social media/tech and crypto but they all look remarkably similar, you could overlay their charts, and they look almost identical.

- These three stocks add weight to our view that US “risk” can pullback further, potentially playing catch up to the ASX growth names.

We think these 3 stocks look fine longer term but another 10% downside wouldnt surprise now the worm appears to have turned.

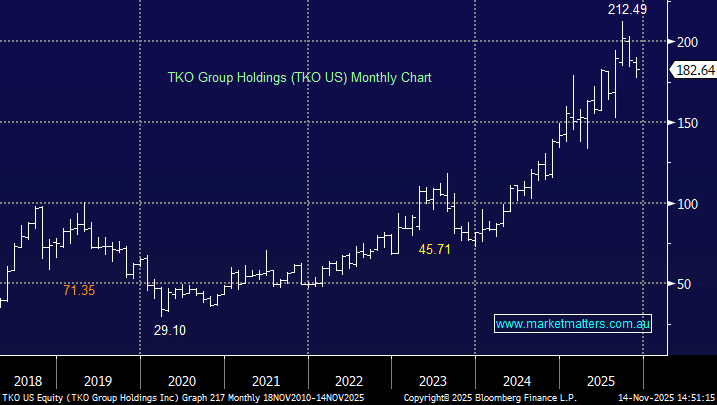

This is the first question or look at TKO Group Holdings (TKO US) hence no history of “Opinion & Action” on the MM Site.

TKO Group Holdings is a premium sports and entertainment company that owns several iconic brands in combat and live-event entertainment. Its portfolio includes Ultimate Fighting Championship (UFC), World Wrestling Entertainment (WWE), and Professional Bull Riders (PBR). It serves a global audience, reaching over 1 billion households across more than 210 countries and territories.

- Revenue is expected to be $US4.7bn in CY25 and $US6.1bn in CY26 .

However, the company is priced for growth and certainly on some investors radar having surged 6x since the COVID lows and is trading on 79x CY25 estimated earnings. The company’s business model is clearly working:

- Live events and media rights – TKO promotes live sports events (UFC, WWE, PBR) and monetises them through ticket sales, pay-per-view, streaming rights, and broadcasting deals.

- Brand licensing and merchandising – The company leverages its powerful IP through merchandise, sponsorships, licensing, and global brand partnerships.

- Acquisitions and growth – TKO actively pursues acquisitions to deepen its footprint in live events, hospitality, sports marketing and global IP. E.g. last year, TKO announced a $US3.25bn asset acquisition from Endeavor Group Holdings, Inc. including IMG, On Location and PBR

This is an impressive business that has reached scale that many thought unlikely 5-years ago. Assuming the people’s choice doesn’t migrate away from the modern-day version of the gladiator’s arena TKO looks set to thrive.

- We like the risk-reward towards TKO around $US170, which would have the stock trading at 20% discount to its average valuation of recent years – not unreasonable in today’s jittery market.