Hi Alain,

Apologies for the oversight, you’re not the first one with this gripe – it’s 100% my fault for missing the question when compiling the report. Apologies again.

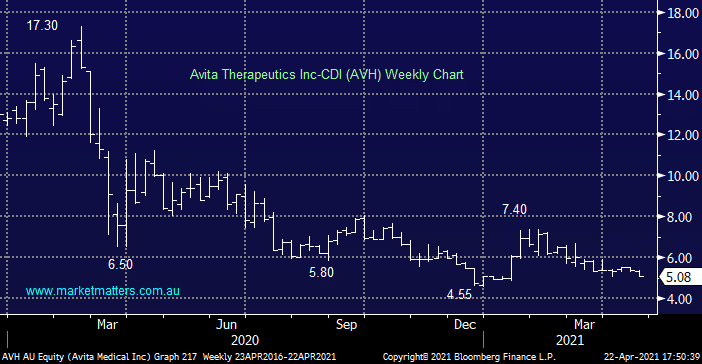

Burns regenerative business AVH remains out of favour with investors as it carries a 4.7% short position but this has been slowly reducing from above 8% in March following a solid 2nd quarter report. They raised ~$70m of capital at $5.88 earlier in the year and has traded below that level pretty much ever since. They are still loss making and COVID has not been kind to them, the new shares on issue post capital raise are dilutive and they still have a long clinical pathway ahead of them, which is costly.

MM is not seeing enough evidence of a turnaround to start accumulating AVH, and we’re not big fans of the biotech space anyway.