Morning Debbie,

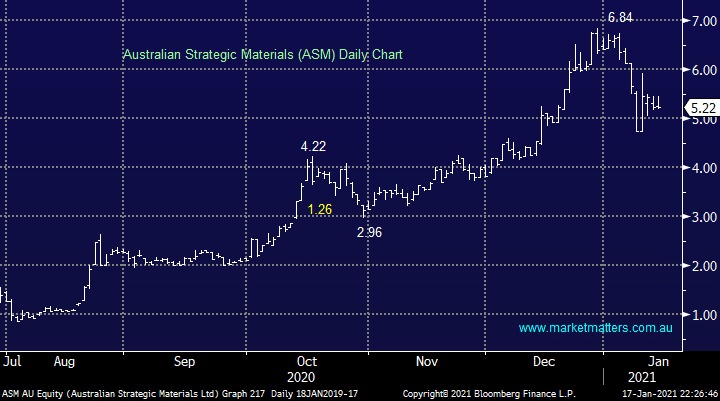

Speciality metals business Australian Strategic Materials (ASM) is in a volatile space, just think Lynas (LYC) and after rallying 600% in under 6-months a pullback is only to be expected, I wouldn’t be surprised to see the stock rotate between $5 and $6 for a few months. Importantly at this stage we see nothing that’s unfolding on the company level to concern us, although it must be said, there is not a lot of research covered of this stock.

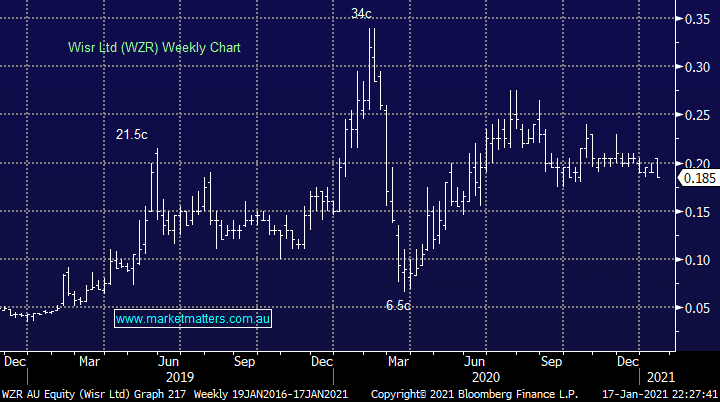

As for WZR, it’s just rotating around like much of the “Buy now pay later” (BNPL) related stocks, apart from sector leader Afterpay (APT). Operationally, they continue to perform well with loan growth hitting records even while they restrict the industries that they lend to (from a risk perspective). The issue in MM’s view is now there is a lot of choice in terms of stocks tapping into the alternative finance space from BNPL to other neo type lenders. We hold WZR in the new MM Emerging Companies Portfolio that will be published on the new website and intend to hold the position, but not add to it for now.

We see no reason to be accumulating the stock at this stage