Hi Darren,

Freeport-McMoRan Inc. (FCX US) is a major $US50bn US-based mining company, best known for being one of the world’s largest producers of copper (Cu). It also produces gold and molybdenum. This week FCX dominated the copper news reporting a deadly mudflow incident at its Grasberg mine in Indonesia, leading to production disruptions and a declaration of force majeure. As a result, the company lowered its Q3 copper and gold sales forecasts, prompting a sharp share price drop and analyst downgrades. Also, as a result copper prices rose due to concerns over tighter global supply.

- The Grasberg mine accounted for ~3.2% of mined Cu this year and 30% of FCX’s total copper and 70% of its total gold.

- FCX now expects copper sales to be 4% lower and gold 6% lower.

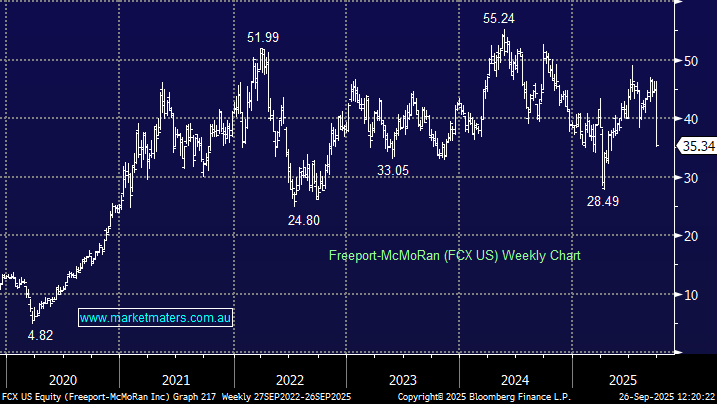

FCX has tumbled over 20% this week which seems excessive assuming they can placate the Jakarta government who control 51% of the critical Grasberg mine, the Govt. could easily go back to the negotiating table and demand a greater share of the mine’s ownership in return for a 20-year extension to operate the mine – the current contract lasts until 2041.

- Politics could come into play here as President Trump looks to defend US companies operating abroad while Indonesian President Prabowo Subianto faces challenging times at home with revenue its Grasberg mine integral to the government’s plans.

We like everything about FCX except the uncertainty around Indonesia, the markets expecting the government to “take” another 10% of the mine, more would be bad for FCX.

- Hence, we term FCX as an accumulate in the $30-35 region.

- We like our position in the MM International Portfolio, just not the week!