Hi David,

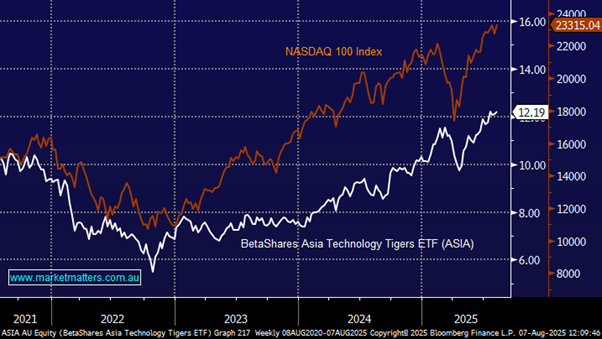

No pressure! The one point you didn’t mention was timeframe hence we’ve considered your question over the medium term. Our pick would be the ASX-traded BetaShares Asia Technology Tigers ETF (ASIA) which has 37% exposure to China, 33% Taiwan and 20% South Korea.

At MM we, like many, believe the AI evolution is in its infancy, and it’s already a major contributory factor in equity market trading around all-time highs as increasing future efficiencies are factored into company’s valuations. The big question is where to search for benefits from AI with the obvious call being the “Mag Seven” but as we saw with DeepSeek which first crossed the newswires in January the Asia and especially China are also likely to produce some major winners in the space.

- The S&P 500 Information Technology sector is trading at a forward P/E of ~30×, a level well above its 5- to 10-year averages of 25× and 21×, respectively.

- Asias core tech sector appears fairly valued relative to its history, trading in the low 20× range.

However, when combined will our bearish medium/long term outlook to the $US Dollar we have a preference for Asian Tech as group although both continue to look good in the years ahead.