Hi Carl,

No small question here and one that’s making many a fund manager question their tech exposure.

Big Tech is planning on spending ~$US650bn on AI development in 2026. However just Microsoft, Alphabet, Meta and Amazon made ~50% of the large Capex spend in FY25 alone. Hence, we don’t see a bursting of a bubble as such because these businesses aren’t trading on exceptionally challenging valuations considering their cash generating models.

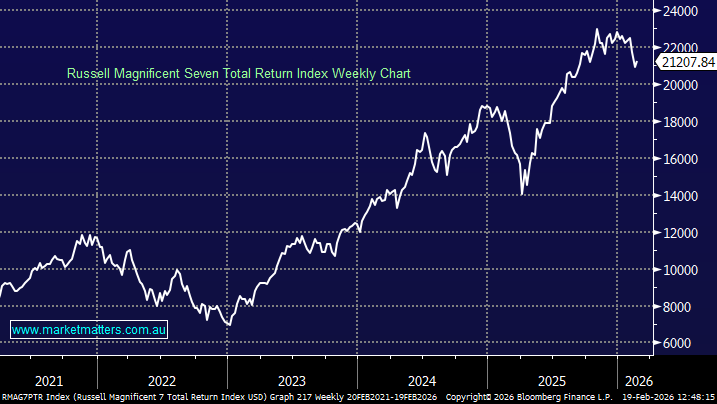

However, we do see periods of weakness when investors become increasing worried around the ROI from the mammoth spend but we remain keen to buy such dips believing the pain won’t resemble what we witnessed during the Dot.com crash. At this stage, we are aware, but not alarmed, given bond issuance is generally supported by a very strong and diverse earnings base of the companies issuing them.

Specifically addressing the threat of a bubble:

We don’t believe AI is a bubble, which are characterised by little real revenue or cash flow, speculation far ahead of real-world use, easy money + hype doing the heavy lifting and when sentiment turns, demand disappears. AI isn’t just a promise, it’s already cutting costs (automation, customer support, coding), increasing productivity (design, research, analytics) and driving enterprise spend today, not “one day”.

Yes, spending is huge on chips, data centres & power, but utilisation is rising, customers are renewing and AI workloads are sticky once embedded. We’re consistently hearing companies say: “We need fewer people” – “We can do this in half the time” – “Margins are expanding because of AI” – we don’t think these real world outcomes are typical of bubbles.