Hi Bernie,

We don’t believe a rate cut by the RBA next week will have a meaningful impact on APA for a couple of reasons:

- Credit markets are pricing in a more than 90% chance of a 0.25% cut next week, the risk is if they don’t cut.

- APA traded ex-dividend 29.5c part-franked last week, with the stock on track to yield around 7% over the next 12-months.

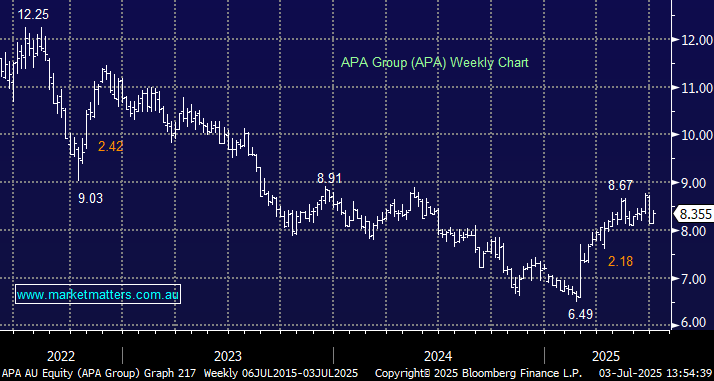

We believe the “easy money” for APA is in the rearview mirror with it trading around its 2025 high if we include the recent dividend, at MM we have been debating using it as a funding vehicle for other purchases. However, we are conscious that its yield should support the stock, especially if futures markets are correct and the RBA cuts three times before Christmas.

In terms of NST, we have discussed the local gold stocks leading the gold price lower a few times in recent weeks. We pointed out in our Macro Monday Reports that long gold was one of the market most “crowded positions” in the market leaving few buyers left to push the sector higher, and plenty of traders capable of bailing on the first sign of weakness. Many investors use Gold ETFs, and when money gets pulled from those, it creates selling in the underlying stocks that comprise the ETF.

- We are looking to increase our exposure to the gold sector but the timing doesn’t feel correct just yet with the sector struggling to bounce this week even when gold enjoyed a few strong sessions.