Hi David,

ALL is a quality business that’s largely falling away in sympathy with rival Light & Wonder (LNW) and US casino and gaming stocks. When compared to its peers its doing ok:

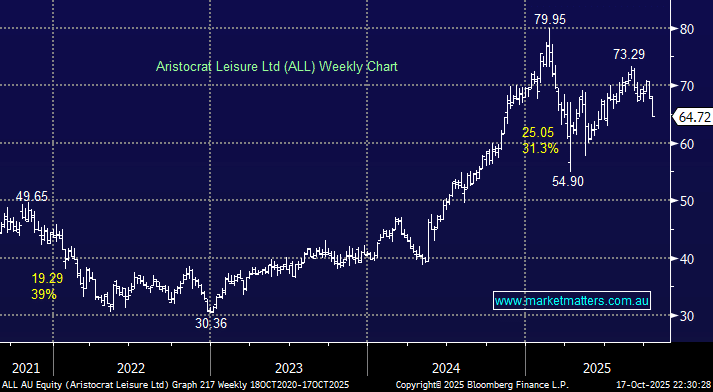

- Over the last 3-months LNW is down -22.7% while ALL has retreated just -3.4%.

- The S&P 500 Casino and Gaming Index has retraced ~15% from its late August high.

We have discussed LNW in another question today with its weakness largely attributable to its delisting on the NASDAQ. However, this months announcement that ALL has reached an agreement to acquire live slot streaming provider Awager from funds managed by Oaktree Capital Management, subject to regulatory pre-approvals, for an undisclosed amount, may have unsettled some fund managers as it introduced a layer of uncertainty into the equation.

On the surface we like the move which aligns with Aristocrat’s strategy to deepen its presence in digital and real-money gaming, adding live streaming technology and an established U.S. iGaming distribution network to its portfolio.

- There are some conserns playing out in terms of growth, larger investors selling down due to ESG issues (Australian Super being on of them), and the price action still looks bearish. However, we sit more on the side of accumulating into weakness, rather than running for the exits.