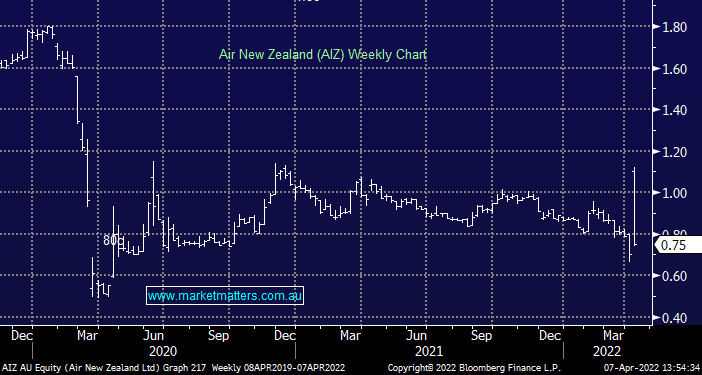

Should investors take up their AIZ Rights?

James, As a holder of AIZ, they have significantly declined since the announced rights offer of 2:1 @ AUD49c. If you held, would you partake in the rights offer? What are the pros & cons please? I am of the mindset I should partake & take up the rights. With thanks, Bernie