Hi Tony,

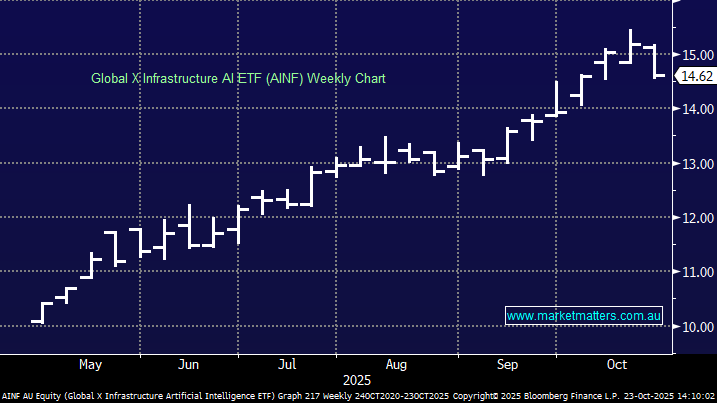

The Global X Infrastructure AI ETF (AINF) is a new ASX vehicle to invest in the physical and operational infrastructure supporting the global expansion of artificial intelligence (AI) which commenced trading in May of this year. Unlike many AI-focused investments that concentrate on software and semiconductor companies, AINF focuses on the underlying systems essential for AI operations, including energy, data, and materials infrastructure.

Its adoption has been slow locally with its market cap only reaching $32mn by Thursday, but it’s much larger on the European bourses. We like this ETFs make up and think its annual cost of 0.57% represents good value:

- Main 5 Regions: 46.8%, US, 14.7% Canada, 8.3% Ireland, 7.2% France, and 6% Chile.

- Main 5 Groups: 33.6% Mining, 21.9% Electrical, 11.5% Machinery, 8.2% Building Materials and 7.6% Electronics.

- Main 5 Holdings: 6.6% Arista Networks, 6% Antofagasta, 5.4% Southern Copper, 5.2% Amphenol and 4.9% Delta Electronics.

Specifically, the AINF ETF aims to track the performance of the Mirae Asset AI Infrastructure Index, which includes companies involved in energy generation and distribution, data centre operations, and materials supply crucial for AI technologies – so far so good, it’s up +16.1% over the last 3-months compared to a +15.8% gain by the index.

- MM is bullish the AINF over the medium term.