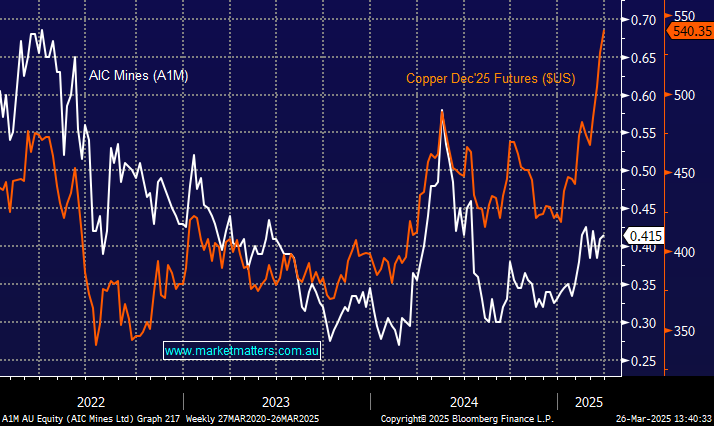

AIC Mines (A1M) share price vs. copper price

I received an email from a Ben Pauley addressed to AIC Mines shareholders. He identifies himself as someone trying to expose dishonest ASX practices. Given the surge in the copper price he believes that the main reason for the languishing AIC share price is the use of custodial accounts by third parties acting for large corporations (Glencore was mentioned) looking for future takeover targets. And he thinks this applies to many mines in the Cloncurry region. He apparently has some history of uncovering similar questionable practices in the past. I assume, as an AIC shareholder you also received this email. What is your opinion of the claims and, if you believe they have some validity, does this affect your investment thesis on AIC? Regards David Hi MM, As an A1M shareholder, what are your views on the various matters raised by Ben Pauley in his 24 March 2025 email to shareholders? Do any of the matters raised concern you at all, including with respect to your plans for the holding over the medium to long-term (noting that you are active investors)? As a related but separate question, all going well, do you view A1M as a potentially good prospect to hold over the long-term? Thanks Darren Hi James and team, I'm interested in your thoughts on the recent series of emails that I (and I assume yourselves as shareholders) have received from a disgruntled A1M shareholder claiming price suppression by custodial holders to benefit a potential takeover by a big player. I must admit to feeling a little frustrated in the way that A1M seems to have hit a ceiling in the face of rising CU prices. The mine seems to be operating smoothly and development and exploration targets seem to be on track as well. Cheers. Craig An email was circulated today (26/03/2025) from Ben Pauley regarding the poor performance of the share price of A1M and influence of Glencore on the share price, assuming you have received said email as you hold this share in your Emerging Companies portfolio . How much credence do you place in the details contained in the email? Do you agree with Ben’s view? How do you see this playing out? Kind regards Matthew